Apr compounded monthly

Divide the APR by. Start Maximizing Your Interest Today.

Answered You Have Just Sold Your House For Mortgage Payoff Selling Your House Payoff

Give your answer in both decimal and percentage form.

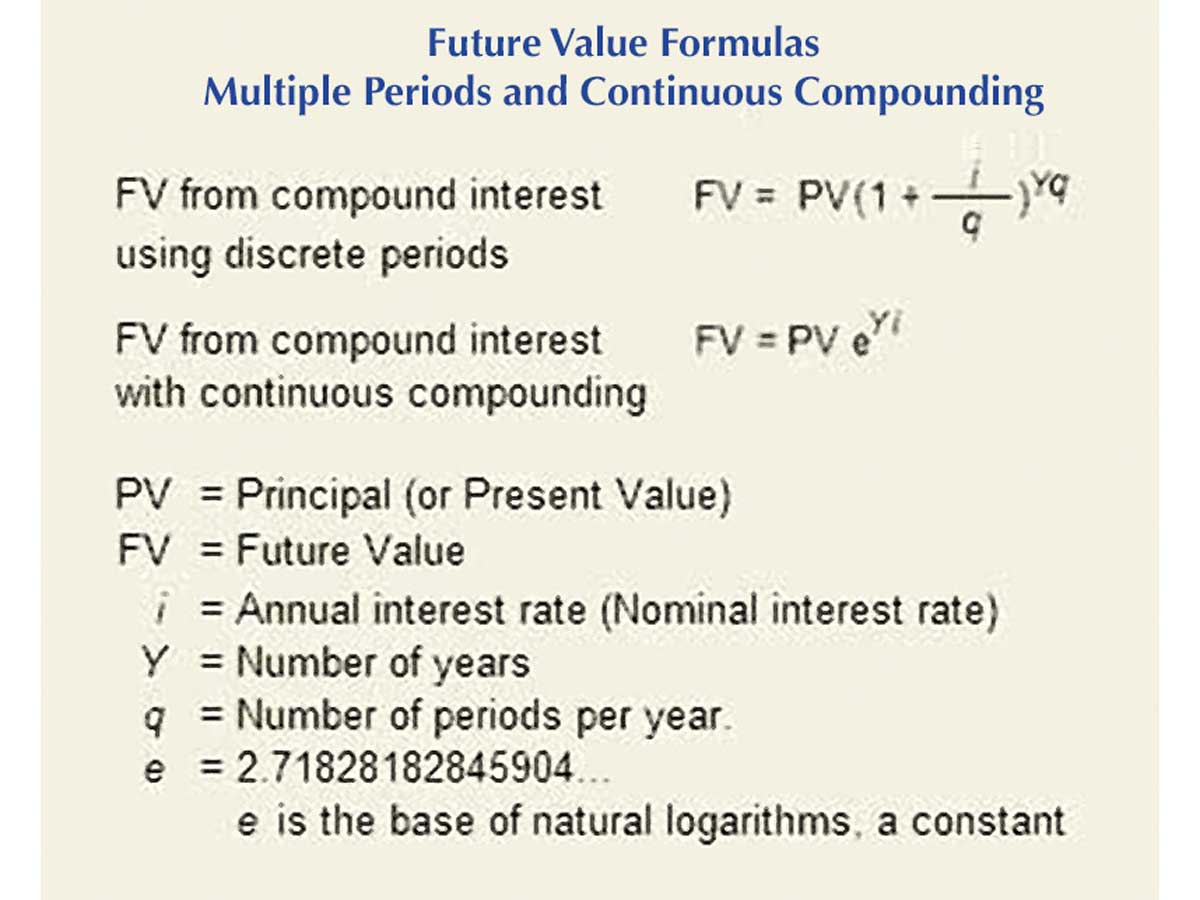

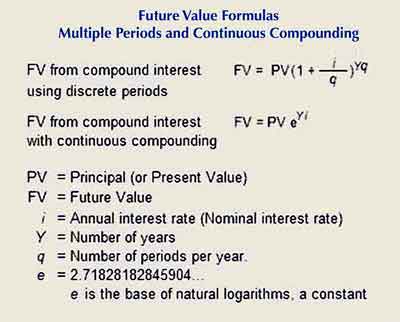

. Ad Expect more from a savings account. Formulas for Calculating Compound Interest Calculating Discrete. Ad 475 Term Loan Promo Rate andor 99 Line of Credit Fee Waiver Offers.

Ad 475 Term Loan Promo Rate andor 99 Line of Credit Fee Waiver Offers. Applications Must be Submitted by June 30 2022. An annual percentage rate is expressed as an interest rate.

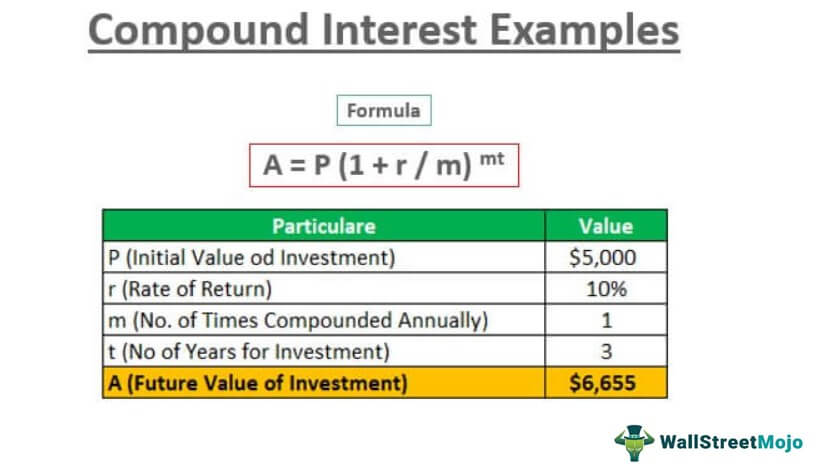

P Rm where R is the annual rate. At 724 compounded 4 times per year the effective annual rate calculated is i 1 r m m 1 i 1 00724 4 4 1 i 0074389 multiplying by 100 to convert to a percentage and rounding. Use this calculator to calculate P the effective interest rate for each compounding period.

FDIC-insured savings with Capital One. Get a top interest rate with Capital One. It calculates what percentage of the principal youll pay each year by taking things such as monthly payments into account.

Mortgage loans home equity loans and credit card accounts usually compound monthly. N - Number of times the interest is. Your credit card charges 1900 APR compounds daily and has a balance of 1000.

Personal Finance Student Loans Credit Cards. Open a New Savings Account in Under 5 Min. Ad View the Savings Accounts That Have the Highest Interest Rates in 2022.

Ad With Competitive APYs And Rock-Bottom Fees Theres A Great Savings Accounts For Everyone. Divide your APR by the number of compounding. No monthly fees to hold you back.

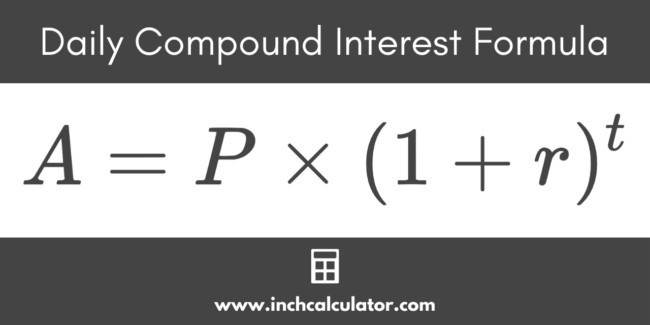

Express your APR as a decimal by dividing by 100. First calculating the periodic yearly. Compounding frequency n is the rule that shows how often the interest gets capitalized and can be Daily 365 timesyear Monthly 12 times per year Quarterly 4 timesyear Semi-annually.

Also an interest rate compounded more frequently tends to appear lower. Number of compounding periods per year. R Interest rate.

If the investment is compounded monthly. Find A Great Account Today. APY 1 rnⁿ 1.

The following table shows the corresponding APR associated with a set compounding frequency for a range of APYs. APR is also the annual rate of interest paid on investments without accounting for the compounding of interest within that year. NerdWallet Makes Finding A Great Savings Account Easy.

The calculation of the annual percentage yield is based on the following equation. For example you want to know the daily periodic. For each of the following accounts determine the percent change per compounding period.

Applications Must be Submitted by June 30 2022. To Apply Talk to a Banker Today. Using the calculator your periods are years nominal rate is 7 compounding is monthly 12 times per yearly period and your number of periods is 5.

For this reason lenders often. To Apply Talk to a Banker Today. The APR does not take into consideration the effects of interest compounding so you can easily calculate the monthly rate.

How To Calculate Interest Compounding For Exponential Growth

Mathematics Of Compounding Accountingcoach

:max_bytes(150000):strip_icc()/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

Compound Interest Explained With Calculations And Examples

Compound Interest Formula Explained Investment Monthly Continuously Word Problems Algebra Youtube

Openalgebra Com Interest Problems

Compound Interest Examples Annually Monthly Quarterly

Dp Maths Compound Interest 10 Apr 17 Subscribe Us Www Youtube Com C Mahendraguruvideos Join Us Facebook Math Study Materials Compound Interest

Continuous Compounding Formula Derivation Examples

Mathematics Of Compounding Accountingcoach

2

Daily Compound Interest Calculator Inch Calculator

Present Value Frequency Of Compounding Accountingcoach

What Is Monthly Compound Interest Formula Examples

Compound Interest Definition Formula How It S Calculated

How To Calculate Interest Compounding For Exponential Growth

How Can I Calculate Compounding Interest On A Loan In Excel

Compound Interest Calculator Daily Monthly Quarterly Annual